- #Splunk inc investor relations full#

- #Splunk inc investor relations software#

- #Splunk inc investor relations plus#

Non-GAAP operating margin is expected to be between 6% and 8%. Total revenues are expected to be between $835 million and $855 million. The company is providing the following guidance for its fiscal third quarter 2023 (ending October 31, 2022):

#Splunk inc investor relations software#

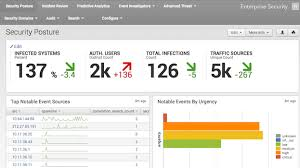

Splunk Ranks First in Both IT Operations and Security Markets in Gartner® Market Share Report: Splunk leads in market share for IT Operations for Health and Performance Analysis (HPA) segment and in the Security Information and Event Management (SIEM) segment, worldwide in the Gartner Market Share: All Software Markets, Worldwide, 2021 report*.By combining the power of Splunk Cloud Platform and Splunk Observability, site reliability engineers and DevOps engineers can access their metrics, traces, and Splunk Cloud logs in a single interface for faster, in-context debugging.

Splunk Log Observer Connect allows customers to visualize all their data in one place.Data Manager for Splunk Cloud Platform delivers a scalable data onboarding experience across Amazon Web Services and Microsoft Azure, with Google Cloud Platform support available later this summer, providing an easy-to-manage hybrid cloud control plane of data flowing into Splunk within minutes.The Splunk Platform, including Splunk Cloud Platform and Splunk Enterprise 9.0, allows customers to access more data sources easily, find and operationalize insights even faster, secure and scale deployments, build cloud-ready custom applications, and streamline administration to turn data insights into business outcomes.conf22: Over 12,500 attendees, including thousands of partners, came together during Splunk’s annual user conference to discuss how organizations are overcoming the barriers between data and action. Splunk Delivers Advancements Across its Products and Partner Community at.

#Splunk inc investor relations plus#

“Given the continued normalization of our revenue model, plus good progress on our expense optimization efforts, we substantially outperformed on the top and bottom lines for the quarter, and we’re increasing our revenue, operating profit and cash flow outlook for the second half.” “In the face of some headwinds, we had solid execution in Q2, including $346 million in cloud revenue, a 59 percent increase over last year,” said Jason Child, CFO of Splunk.

These customers appreciate the unique and unmatched level of visibility we provide into their data and consider Splunk their partner of choice to secure and strengthen their mission critical operations.” “Splunk is well-positioned to deliver long-term, durable growth and profitability as we help the world’s largest and most innovative enterprises improve their cybersecurity and business resilience. We also delivered substantially higher non-GAAP operating margin for the quarter, driven by our laser focus on balancing growth with profitability,” said Gary Steele, President and CEO of Splunk. “The value we bring customers is evident in our Q2 results, with total revenues growing 32 percent. Total revenues were $799 million, up 32% year-over-year.Ĭloud revenue was $346 million, up 59% year-over-year.Ĭloud Dollar-Based Net Retention Rate was 129%.ħ23 customers with total ARR greater than $1 million, up 24% year-over-year. (NASDAQ: SPLK), the data platform leader for security and observability, today announced results for its fiscal second quarter ended July 31, 2022.

#Splunk inc investor relations full#

Increases Full Year Revenue, Profitability and Cash Flow Outlook Total Revenues Grow 32% Cloud Revenue up 59%

0 kommentar(er)

0 kommentar(er)